Is a weaker Canadian dollar clipping travellers' wings? Would-be vacationers could find themselves paying 30 per cent more for their warm-weather getaways this year. As the Loonie hovers around US$0.75, three-quarters admit the weak currency has impacted their trip plans.

But cash-strapped travelers needn't settle for a staycation, as a number of travel rewards credit cards can effectively offset travel costs.

However, using plastic to fund a vacation can be a point of confusion. While there are a number of fantastic travel offers available in today's market, many Canadians aren't aware of travel rewards best practices, and there continue to be misconceptions around the true value of rewards, and how to effectively earn and redeem them.

To help Canadians take flight faster, RateSupermarket.ca has revealed the Guide to Flying for Free - How to Cash in Travel Rewards Credit Card Points. The guide provides clarity on choosing the right card, and insight to the value offered by popular rewards programs.

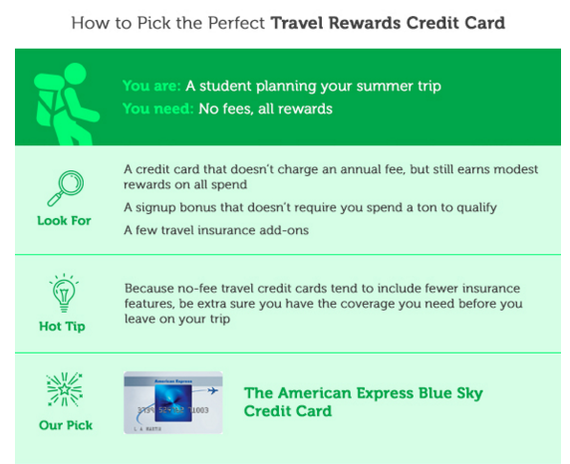

How to Pick the Perfect Travel Rewards Credit Card

![2016-03-11-1457714538-2597125-FlyforFreestudent.png]()

![2016-03-11-1457714687-7775015-FlyforFreefamily.png]()

![2016-03-11-1457714729-1888842-Flyforfreecouple.png]()

![2016-03-11-1457714767-3345457-Flyforfreefrequentflyer.png]()

How Big is That Bonus... Really?

We've all seen the ads -- sign up today and get 50,000 points! Seems like a really sweet deal -- but how much is a point really worth? It depends on the card and the way you redeem. Here's a breakdown of what the most popular points in Canada are worth* when cashed in for travel:

American Express Blue Sky Points

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Great: Book any travel and apply points to your balance. A minimum 10,000 is required to redeem. Points are converted to statement credits of $100 each, which can then be applied to any travel purchase.

Blackouts or Restrictions: No

American Express Gold Rewards Points

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Great: Book any travel and apply points to your balance. A minimum 10,000 is required to redeem. Points are converted to statement credits of $100 each, which can then be applied to any travel purchase.

Blackouts or Restrictions: No

BMO Rewards

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Good: Travel must be booked through the BMO Rewards travel agency, either online or over the phone. You must have a minimum of 100 points to redeem. If you don't have enough points to cover your trip, you can pay the remainder with your credit card.

Blackouts or Restrictions: No

Capital One reward miles

Each: $0.01 each

Points needed for $100 in travel: 10,000

Redemption - Great: Simply charge your travel expense to your card, then apply points to your balance. There is no point minimum required to redeem, and points can be used to pay taxes and other surcharges.

Blackouts or Restrictions: No

CIBC Aventura Points

Each: $0.03

Points needed for $100 in travel: approx. 3,300

Redemption - Ok: Travel must be searched for via the CIBC Aventura rewards portal, which includes all airlines. Flight types are classified as long haul, short haul, domestic and international, and require a minimum number of points to qualify per category. There is a maximum cap on the number of points you can redeem, and points cannot be used to pay for taxes and other surcharges.

Scotia Rewards Points

Each: $0.01 each

Points needs for $100 in travel: 10,000

Redemption - Great: Simply charge your travel expense to your card, then log into your Scotia Rewards account to apply points to your balance. There is no point minimum required to redeem, and points can be used to pay taxes and other surcharges.

Blackouts or Restrictions: No

RBC Rewards Points

Each: $0.023

Points needed for $100 in travel: approx. 4,300

Redemption - Ok: Redeem your points online via the RBC Orbitz portal, over the phone, or via Carlson Wagonlit Travel. Flight types are classified as long haul, short haul, domestic and international, and require a minimum number of points to qualify per category. There is a maximum cap on the number of points you can redeem, and points cannot be used to pay for taxes and other surcharges.

AIR MILES

Each: $0.15 each (varies based on flight redemption)

Points needs for $100 in travel: Approx. 667

Redemption - Ok: Flights must be booked via AIR MILES' Dream Rewards Centre, which prices point requirements based on mileage. Redemption costs are higher during the high season, and AIR MILES cannot be used to pay for taxes and other surcharges.

Blackouts or Restrictions: No

Aeroplan Miles

Each: $0.23 each

Points needs for $100 in travel: approx. 4,300

Redemption - Ok: Travel must be booked by the Aeroplan rewards portal, and are restricted to Air Canada and other partner airlines. Point redemption is divided into two tiers: Fixed Mileage and Market Fare. Fixed Mileage Flight Rewards travel can be booked for fewer points, but are subjected to limited availability and seasonality.

Blackouts or Restrictions: Some seat restrictions

TD Rewards

Each: $0.005

Points needs for $100 in travel: 20,000

Redemption - Good: Book travel on any airline, or book through Expedia for TD, then log in in to your TD Rewards Account to pay with your points. Points can also be used to pay for taxes and additional surcharges.

Blackouts or Restrictions: No

*Based on value of signup bonus. Note values may vary depending on redemption method, flight seasonality and flight class).

Tips for Using a Travel Rewards Credit Card

Seek out the perfect plastic: There is a wide variety of travel rewards programs to choose from and each offers a different earning and redemption structure. It's important to determine whether a card's earning potential can be maximized based on your specific spending habits -- for example, gas and grocery purchases, or earning on all spending.

Heed the fee:

Travel rewards cards are often packed with additional insurance, concierge and lounge benefits -- and that means the majority charge an annual fee. Look for cards that waive this charge for a limited promotional period, and determine whether your annual earnings offset the fee amount. For those who are fee adverse, a non-fee card with a lower earning threshold can be a better fit.

Ask about redemption:

Those points won't do much good if they're grounded during your desired departure season. Seat capacity, seasonal, and minimum redemption restrictions are common pitfalls vacationers should be aware of. For the greatest flexibility, look for cards that allow points to be redeemed directly on travel purchases charged on the card.

Cover yourself:

Many travel cards come with built-in insurance benefits -- but you shouldn't assume you're covered. At a bare minimum, ensure you have sufficient travel medical and accident insurance for yourself, spouse and any dependents travelling with you. Add-ons like trip interruption, delay and cancellation coverage can provide greater peace of mind on your journey.

* Preparing for Takeoff: Air travel outlook for 2016 - Expedia.ca

MORE ON HUFFPOST:

But cash-strapped travelers needn't settle for a staycation, as a number of travel rewards credit cards can effectively offset travel costs.

However, using plastic to fund a vacation can be a point of confusion. While there are a number of fantastic travel offers available in today's market, many Canadians aren't aware of travel rewards best practices, and there continue to be misconceptions around the true value of rewards, and how to effectively earn and redeem them.

To help Canadians take flight faster, RateSupermarket.ca has revealed the Guide to Flying for Free - How to Cash in Travel Rewards Credit Card Points. The guide provides clarity on choosing the right card, and insight to the value offered by popular rewards programs.

How to Pick the Perfect Travel Rewards Credit Card

How Big is That Bonus... Really?

We've all seen the ads -- sign up today and get 50,000 points! Seems like a really sweet deal -- but how much is a point really worth? It depends on the card and the way you redeem. Here's a breakdown of what the most popular points in Canada are worth* when cashed in for travel:

American Express Blue Sky Points

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Great: Book any travel and apply points to your balance. A minimum 10,000 is required to redeem. Points are converted to statement credits of $100 each, which can then be applied to any travel purchase.

Blackouts or Restrictions: No

American Express Gold Rewards Points

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Great: Book any travel and apply points to your balance. A minimum 10,000 is required to redeem. Points are converted to statement credits of $100 each, which can then be applied to any travel purchase.

Blackouts or Restrictions: No

BMO Rewards

Each: $0.01

Points needed for $100 in travel: 10,000

Redemption - Good: Travel must be booked through the BMO Rewards travel agency, either online or over the phone. You must have a minimum of 100 points to redeem. If you don't have enough points to cover your trip, you can pay the remainder with your credit card.

Blackouts or Restrictions: No

Capital One reward miles

Each: $0.01 each

Points needed for $100 in travel: 10,000

Redemption - Great: Simply charge your travel expense to your card, then apply points to your balance. There is no point minimum required to redeem, and points can be used to pay taxes and other surcharges.

Blackouts or Restrictions: No

CIBC Aventura Points

Each: $0.03

Points needed for $100 in travel: approx. 3,300

Redemption - Ok: Travel must be searched for via the CIBC Aventura rewards portal, which includes all airlines. Flight types are classified as long haul, short haul, domestic and international, and require a minimum number of points to qualify per category. There is a maximum cap on the number of points you can redeem, and points cannot be used to pay for taxes and other surcharges.

Scotia Rewards Points

Each: $0.01 each

Points needs for $100 in travel: 10,000

Redemption - Great: Simply charge your travel expense to your card, then log into your Scotia Rewards account to apply points to your balance. There is no point minimum required to redeem, and points can be used to pay taxes and other surcharges.

Blackouts or Restrictions: No

RBC Rewards Points

Each: $0.023

Points needed for $100 in travel: approx. 4,300

Redemption - Ok: Redeem your points online via the RBC Orbitz portal, over the phone, or via Carlson Wagonlit Travel. Flight types are classified as long haul, short haul, domestic and international, and require a minimum number of points to qualify per category. There is a maximum cap on the number of points you can redeem, and points cannot be used to pay for taxes and other surcharges.

AIR MILES

Each: $0.15 each (varies based on flight redemption)

Points needs for $100 in travel: Approx. 667

Redemption - Ok: Flights must be booked via AIR MILES' Dream Rewards Centre, which prices point requirements based on mileage. Redemption costs are higher during the high season, and AIR MILES cannot be used to pay for taxes and other surcharges.

Blackouts or Restrictions: No

Aeroplan Miles

Each: $0.23 each

Points needs for $100 in travel: approx. 4,300

Redemption - Ok: Travel must be booked by the Aeroplan rewards portal, and are restricted to Air Canada and other partner airlines. Point redemption is divided into two tiers: Fixed Mileage and Market Fare. Fixed Mileage Flight Rewards travel can be booked for fewer points, but are subjected to limited availability and seasonality.

Blackouts or Restrictions: Some seat restrictions

TD Rewards

Each: $0.005

Points needs for $100 in travel: 20,000

Redemption - Good: Book travel on any airline, or book through Expedia for TD, then log in in to your TD Rewards Account to pay with your points. Points can also be used to pay for taxes and additional surcharges.

Blackouts or Restrictions: No

*Based on value of signup bonus. Note values may vary depending on redemption method, flight seasonality and flight class).

Tips for Using a Travel Rewards Credit Card

Seek out the perfect plastic: There is a wide variety of travel rewards programs to choose from and each offers a different earning and redemption structure. It's important to determine whether a card's earning potential can be maximized based on your specific spending habits -- for example, gas and grocery purchases, or earning on all spending.

Heed the fee:

Travel rewards cards are often packed with additional insurance, concierge and lounge benefits -- and that means the majority charge an annual fee. Look for cards that waive this charge for a limited promotional period, and determine whether your annual earnings offset the fee amount. For those who are fee adverse, a non-fee card with a lower earning threshold can be a better fit.

Ask about redemption:

Those points won't do much good if they're grounded during your desired departure season. Seat capacity, seasonal, and minimum redemption restrictions are common pitfalls vacationers should be aware of. For the greatest flexibility, look for cards that allow points to be redeemed directly on travel purchases charged on the card.

Cover yourself:

Many travel cards come with built-in insurance benefits -- but you shouldn't assume you're covered. At a bare minimum, ensure you have sufficient travel medical and accident insurance for yourself, spouse and any dependents travelling with you. Add-ons like trip interruption, delay and cancellation coverage can provide greater peace of mind on your journey.

* Preparing for Takeoff: Air travel outlook for 2016 - Expedia.ca

Follow HuffPost Canada Blogs on Facebook

MORE ON HUFFPOST:

-- This feed and its contents are the property of The Huffington Post, and use is subject to our terms. It may be used for personal consumption, but may not be distributed on a website.